Sugar free tea, it's starting to roll up

- Author:BY

- Origin:Internet

- Time of issue:2024-06-12 10:49

- Views:

(Summary description)

Sugar free tea, it's starting to roll up

(Summary description)

- Categories:Younger Trend

- Author:BY

- Origin:Internet

- Time of issue:2024-06-12 10:49

- Views:

The sugar free tea beverage market is booming, with brands competing to create new products and quality becoming the core competitiveness.

The most satisfying beverage on convenience store refrigerators and shelves today is undoubtedly sugar free tea. Before fully entering summer, the shelves of convenience stores are already prominently filled with various sugar free tea drinks.

2023 is seen as the first year of the outbreak of sugar free tea drinks. In recent years, the status of sugar free tea products in the minds of consumers has gradually risen, ushering in a prosperous era. This category will completely explode in 2023, with crowded tracks and numerous players, giving it a strong momentum of cooking oil. Nowadays, the weather is gradually getting hot, and new products are emerging on the sugar free tea track. Convenience store refrigerators are also being squeezed out.

Sugar free tea drinks are densely updated

Is sugar free tea still popular in 2024?

The popularity of Dongfang Ye's first batch of Mingqian Longjing new tea this year reflects the continued popularity of sugar free tea drinks in the minds of consumers. On April 5, according to the news released on the official official account of Nongfu Mountain Spring, on April 1, the first 50000 cases of Longjing New Tea before tomorrow sold out in just 17 hours. The second batch of products was launched on April 5th, and 50000 boxes were sold out within an hour.

The popularity of Dongfang Ye is at the forefront, and other beverage brands are also rushing to release new sugar free tea products.

In early May, Kangshifu launched the "Inheritance of Tea" original sugar free tea, which has two flavors: Minnan Tieguanyin and Yunnan Pu'er, targeting a price range of 5 yuan.

In early March, Kangshifu also launched new products such as sugar free oolong tea and sugar free jasmine tea/green tea, continuously enriching the sugar free tea drink matrix. In a official account called "Kang Yin Hua East District Promotion Platform", the display guide of sugar free tea series products was also released. It is suggested to set up a sugar free tea area on the third floor of the freezer.

A few days later, the official flagship store of Panpan Food also launched a new version of Dahongpao sugar free tea, priced at 9.9 yuan per bottle (before the discount). According to the product page of the official flagship store, Panpan Dahongpao Sugar Free Tea selects Fujian Dahongpao tea leaves, uses real tea leaves, and brews them at high temperature to fully release the tea aroma.

However, during the visit, a reporter from Consumer Reports only saw the new product of Kangshifu's "tea successor" being sold in one supermarket, and the new product of Panpan Dahongpao was not available for sale. Regarding this, Consumer Reports recently sent interview letters to Kangshifu and Panpan, but as of the time of publication, no response has been received.

In fact, as early as early as early March, many brands launched their own sugar free tea drinks before the peak summer beverage consumption season. At the beginning of the year, there was a call to compete in the production of sugar free tea. In April, a new sugar free tea product called "Spring Breeze Green Tea" was launched, promoting innovative fermentation techniques and integrating traditional green tea with modern technology.

Wahaha also launched its first sugar free tea product in early March this year, offering four flavors of sugar free tea drinks: Zhengshan Xiaozhong, Dahongpao, jasmine tea, and Qinggan Pu'er.

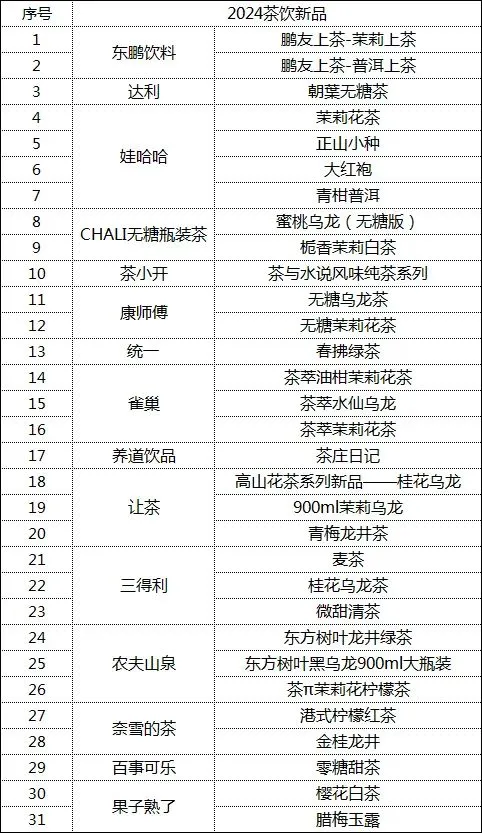

In the hot trend of sugar free tea, sub categories of tea drinks such as lemon tea and herbal herbal herbal tea are also following the trend of sugar free by subtracting. Vita Lemon Tea updated its packaging at the end of March, launching a new product that emphasizes "0 sugar, 0 fat, and 0 energy". On May 24th, Wang Laoji, who sells herbal tea, couldn't sit still and launched a new product of sugar free original herbal tea for the first time. According to Food Board, as of mid May, 31 new tea drinks have been launched.

In traditional Chinese culinary culture, tea is an indispensable presence. The tea polyphenols contained in tea have significant benefits for cardiovascular health. Sugar free tea drinks not only address the health concerns of young people about excessive sweetness intake, but also solve the problem of difficulty in drinking plain water.

After sweet drinks dominated the taste buds of consumers for more than a decade, the current popularity of sugar free tea is only natural. According to Nielsen IQ data, the domestic sugar free beverage industry's revenue in 2023 was 24.1 billion yuan, a year-on-year increase of 26%. This growth rate mainly comes from the contribution of sugar free tea. In 2023, the overall growth rate of the domestic beverage industry was 6%, that is, the growth rate of drinking tea was 19%, and the sugar free tea sub category contributed 110% year-on-year growth.

The financial data of top instant tea companies can also give a glimpse of the popularity of sugar free tea drinks. Suntory's 2023 fiscal year annual report shows a total revenue of 1.59 trillion yen, a year-on-year increase of 9.74%, and a profit of 82.743 billion yen; In its first half of 2023 performance, sugar free tea beverages accounted for a portion of the company's sales.

Oolong tea is a representative category of sugar free tea that was initially popular. With the increasing number of entrants, sugar free tea drinks have also opened up in various directions such as tea variety, taste, craftsmanship, origin, and culture.

More and more brands are targeting and laying out new flavors such as Tie Guan Yin, Pu erh tea, Da Hong Pao, and Bi Luo Chun. Like the sugar free tea drinks such as Zhengshan Xiaozhong, Dahongpao, and Qinggan Pu'er launched by Wahaha in March this year; Let tea launch new products such as Qingmei Longjing tea.

In terms of tea varieties, the advantage of origin is emphasized and highlighted. In the "Inheritance of Tea" series of new products by Master Kang, two representative varieties were selected: "Tieguanyin from Minnan" and "Pu'er from Yunnan". Nestle Tea Extract launched a new product, Narcissus Oolong, to select famous tea from Mount Wuyi, Fujian, and jasmine tea from Hengzhou, Guangxi.

In terms of tea drinking technology, low-temperature extraction, low-temperature slow brewing, innovative fermentation and other processes have been promoted by a number of brands as selling points. In April this year, Dongpeng Beverage also announced that it had reached cooperation with Zhejiang Tiancao Biotechnology Co., Ltd. and the State Key Laboratory of Tea Biology and Resource Utilization of Anhui Agricultural University to jointly build a joint research center for tea deep processing and beverage development. Dongpeng Beverage stated that it will conduct basic research on tea raw materials based on their distribution of origin, quality stability, processing technology, and the development process of related tea beverage products.

Is there a resurgence of price wars?

Consumers pay for sugar free tea drinks, while businesses engage in price wars over it. In the context of numerous sugar free tea products, price wars are inevitable in order to attract more consumers in the hot market.

Last March, the topic of "price war" at Suntory became a hot topic in search. In the pictures posted by netizens, the official suggested retail price of Suntory Oolong tea, which costs 5 yuan, is 3.8 yuan per bottle on supermarket shelves. This news once sparked discussions about the "price war" of sugar free tea.

Recently, Consumer Reports conducted a survey of several offline convenience stores in Guangzhou and noticed that several brands such as Chun Tea House and Suntory have launched certain promotional activities.

At a Shengjia supermarket in Tianhe District, Chun Tea House can participate in a 2.99 yuan flash sale promotion by scanning the QR code from May to June. In addition, at an Yongwang supermarket in Tianhe District, Sandeli Osmanthus Oolong and barley tea are priced at 3.9 yuan per bottle.

The promotion and discount intensity of online channels is greater than that of offline channels. On May 23rd, the new product of Suntory's 500ml sugar free barley tea was priced at 56 yuan per bottle on Tmall's official flagship store, with an average price of 3.7 yuan per bottle. The price of Ito Garden's 500ml strong flavored green tea on Tmall Supermarket is 56.9 yuan for 15 bottles, with an average selling price of 3.79 yuan per bottle.

There are many competitors in the same category of sugar free tea drinks, and even with price adjustments, manufacturers are not willing to easily adjust their retail prices. In early May, Suntory also issued a price adjustment notice to Chinese distributors, and on May 1st, adjusted the prices of some products, including 500ml Oolong Tea Super Narcissus Sugar Free (15 in), 500ml Oolong Tea Super Narcissus Low Sugar (15 in), and 1250ml Oolong Tea Super Narcissus (6 in). However, the suggested retail price is still 5 yuan.

From roll variety, roll craftsmanship, to roll price, various brands are competing fiercely in the sugar free tea drink market. Who would be chosen between the dimensions of convenience store refrigerators? Who will be left behind?

Chinese food industry analyst Zhu Danpeng believes that the popularity of sugar free tea stems from the long-term accumulation and development of enterprises.

At present, the overall consumption trend is developing in the direction of big health management. In order for enterprises to stand out in this rapidly developing track, brand power, channel power, product power, and promotion power are indispensable, and the most core of them is still product quality. "In the context of high-quality development, quality assurance is a core element that enterprises rely on for survival and development."

Scan the QR code to read on your phone

Global FMCG Youth Innovation Group

Service Hotline: 400 920 0986

E-mail:info@bygroup.net.cn

COPYRIGHT © 上海哔喂品牌营销咨询有限公司

-

-

-

Customer Service

Time:9:30 — 6:30

Tel:

-